Federal estimated tax payments 2021

Estimated tax payments for Q1 2021 are still due on April 15 2021. Ad Get A Quick Estimate On How Much You May Get Back Or Owe With Our Free Calculator.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

. In addition if you dont elect voluntary withholding you should make estimated tax payments on other. This estimator may be utilized by virtually all taxpayers. Estimate Tax PaymentsSeptember 2021 Tax News.

Use this secure service to pay your taxes for Form 1040 series estimated taxes or other associated forms directly from your checking or savings account at no cost to you. 90 of the expected taxes of your 2022 Tax Return or. You can easily keep track of your payment by signing up for email notifications about your tax payment each time you use IRS Direct Pay.

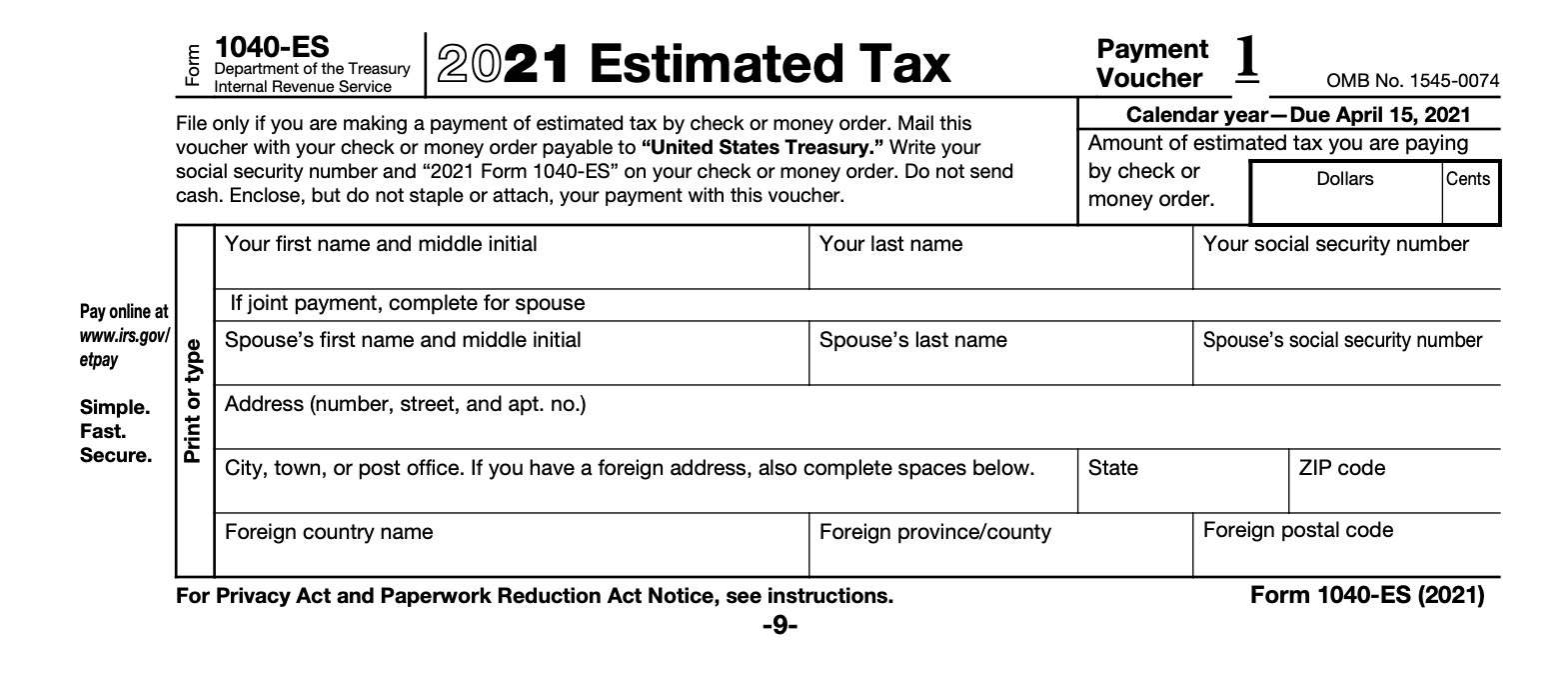

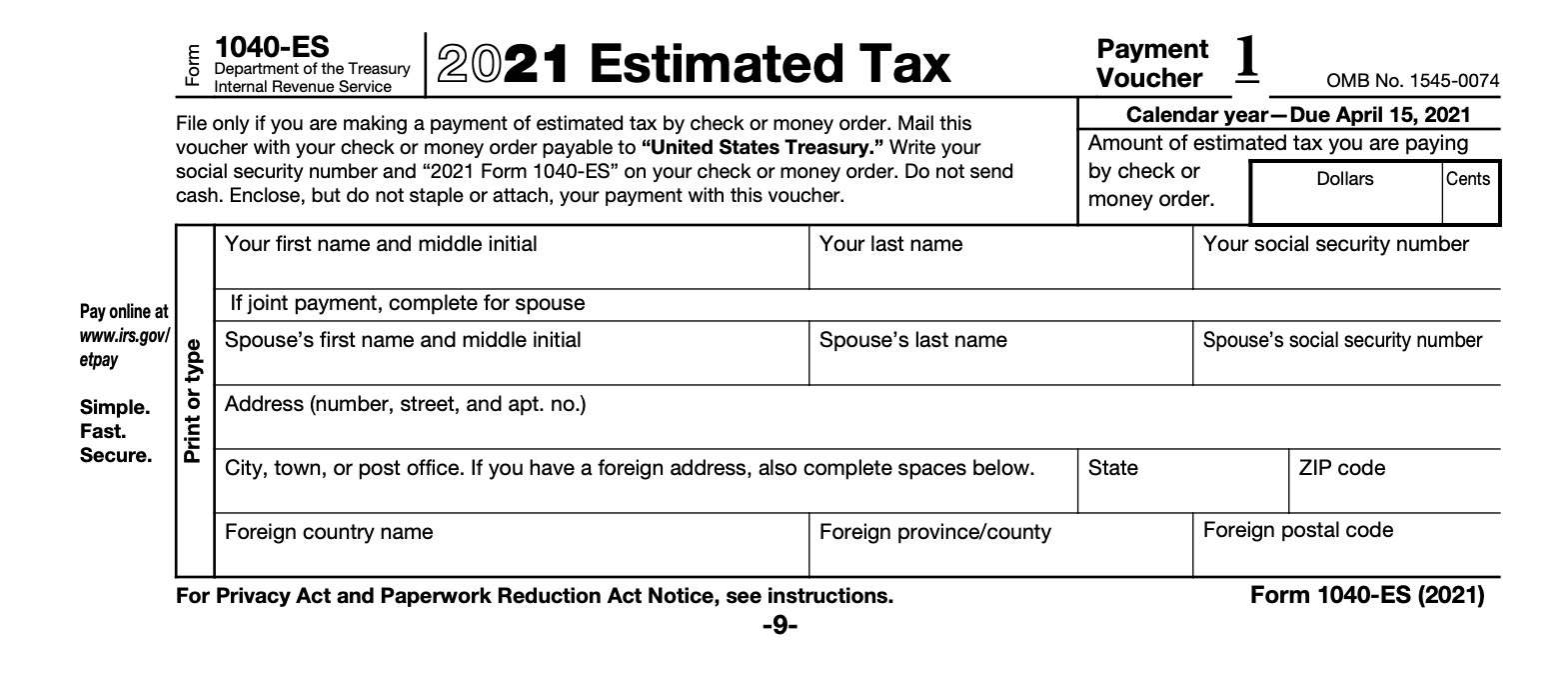

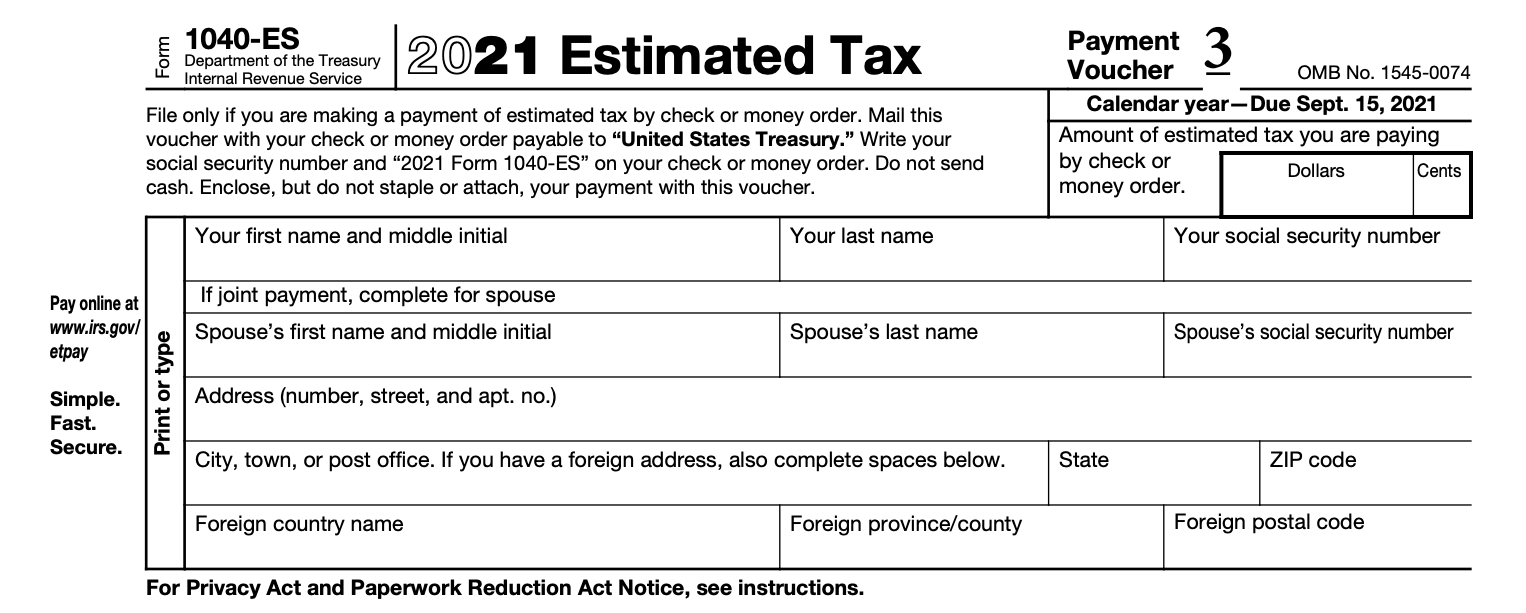

The due dates are generally April 15 June 15 September 15 and January 15 but if they fall on a weekend or holiday the deadline is moved to the next workday. Mailing your payment check or money order with a payment voucher from Form 1040-ES. In other words you can use your exact figure from your previous year return or you can estimate within 10 of your anticipated 2022 tax.

Mail a check or money order with Form 1040-ES. 425 57 votes The deadline for making a payment for the fourth quarter of 2021 is Tuesday January 18 2022. Estimate Your Taxes For Free And Get Ahead On Filing Your Tax Returns Today.

If the amount of income tax withheld from your income is not enough then you may be required to make estimated tax payments and if you dont make enough tax through withholding andor estimated tax payments then you may be charged a penalty underpayment of estimated tax. Federal income tax includes additional Medicare tax withholding from line 24 of federal form 8959. As a partner you can pay the estimated tax by.

Federal Tax Withheld Enter the amounts listed in the box labeled Federal income tax withheld on the W-2 or 1099 forms that you received. Estimated Tax for Individuals. Use Form 1040-ES to figure and pay your estimated tax for 2022.

Payment Amount Due date. To figure your estimated tax payments if required use Form 1040-ES. From time to time the actual day slides due to holidays and weekends.

Federal individual income tax returns and paymentsusually April 15 but in 2022 its. Tax Day is the due date for US. The result is your self-employment tax.

100 of the taxes shown on your 2021 Tax Return. Ad Use Our Free Powerful Software to Estimate Your Taxes. 100 of the tax shown on your 2021 federal tax return only applies if your 2021 tax return covered 12 months - otherwise refer to 90 rule above only.

The partners may need to pay estimated tax payments using Form 1040-ES Estimated Tax for Individuals. Use the Electronic Federal Tax Payment System EFTPS to submit payments electronically. Apply your 2021 refund to your 2022 estimated tax.

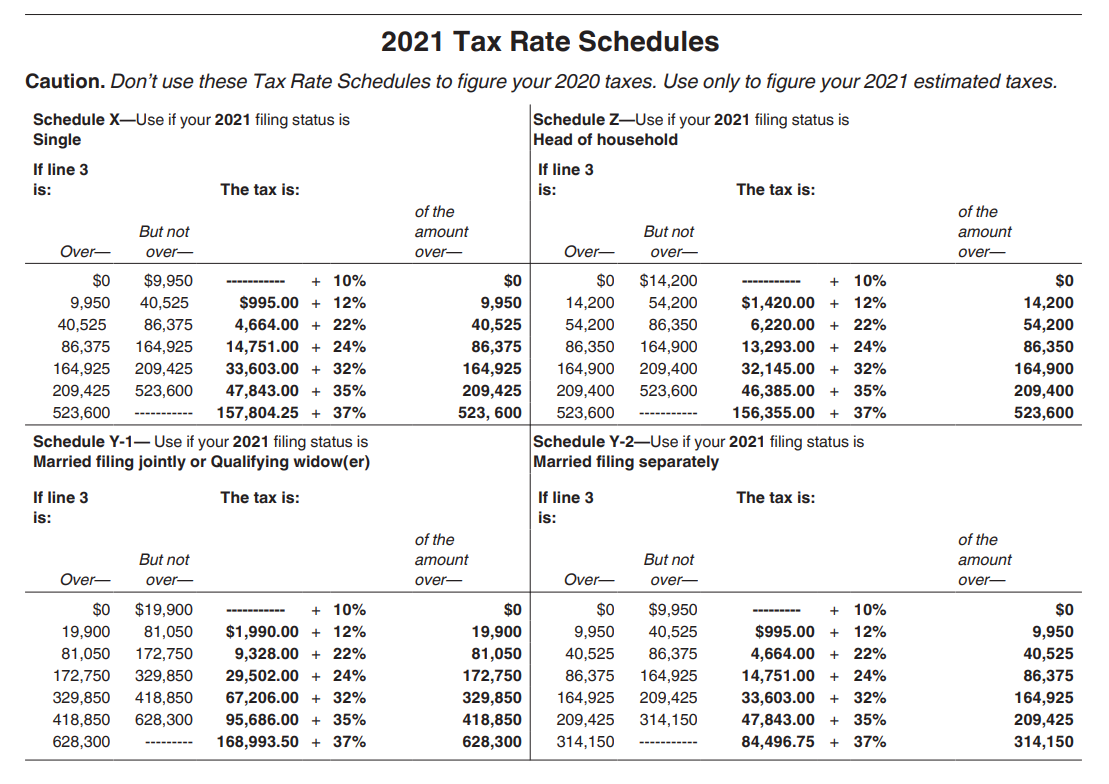

Estimated Tax Due Dates for Tax Year 2022. Take your net profit from Schedule C and multiply it by two numbers. California estimated tax payments are due as follows.

Self-employment tax is part of your overall tax liability and is one thing that makes estimating total tax liability difficult. This tax calculator assists you identify how much withholding allowance or additional withholding has to be documented with your W4 Form. There is a formula you can use to figure your self-employment tax.

To calculate your federal quarterly estimated tax payments you must estimate your adjusted gross income taxable income taxes deductions and credits for the calendar year 2022. September 1 2022 to December 31 2022. In either case you will still owe taxes at the end of the year but you will not face penalties and interest.

Crediting an overpayment on your 2021 return to your 2022 estimated tax. Estimate taxable income for the year. Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self-employment interest dividends rents alimony etc.

A step by step guide to calculating your estimated taxes. For 2022 the dates for estimated tax payments are. And those dates are roughly the same each year the 15th of April June September and the following January.

The postmark date lets the IRS know if the estimated tax. The estimated tax payments are due on a quarterly basis. See What Credits and Deductions Apply to You.

This means that taxpayers need to pay most of their tax during the year as income is earned or received. The dates above are when your 1040-ES should be postmarked. Add it all together and divide by four.

Report on line 31 all federal tax withheld estimated tax payments and federal taxes paid in 2021. For our new or returning tax professionals please be aware that the California estimated tax schedule differs from federal. Lets start with Stephanies income tax.

Income taxes are pay-as-you-go. You can make estimated tax payments using any of these methods. Taxpayers whose adjusted gross income is 150000 or more must make a payment equal to 110 of the previous years taxes or 90 of the tax for the current year.

Enter Your Tax Information. Visit wwweftpsgov or call 1-800. The IRS provides a worksheet for Form 1040 ES.

Federal Estimated Tax Payments 2021 The tax withholding estimator 2021 allows you to definitely determine the federal income tax withholding. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 941 Employer S Quarterly Federal Tax Return Definition

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Estimated Tax Payments Youtube

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Schedule

Solved How Do You Categorize An Estimated Tax Payment On Qb I Know It S Not An Expense What Is It

When Are Taxes Due In 2022 Forbes Advisor

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

:max_bytes(150000):strip_icc()/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

Form 4868 Application For Extension Definition

Form 1099 Nec For Nonemployee Compensation H R Block

/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 941 Employer S Quarterly Federal Tax Return Definition