Iron Ore Price Forecast Goldman Sachs

The iron ore market cant catch a break The slowdown in China has already hammered prices by close to 50 percent this year and now Goldman Sachs has slashed its price forecastForecasts for iron ore prices raised after 62 FeGoldman Sachs lifted its iron ore price forecast by 12 to 91mt Goldman Sachs and RBC both noted that the iron. Iron ore prices are likely to remain elevated and volatile in the near term according to Goldman Sachs.

Wsj News Graphics Wsjgraphics Twitter Commodity Prices Metal Prices Graphic

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

Iron ore price forecast goldman sachs. Goldman analysts led by Nicholas Snowdon have upgraded their 12-month price target for copper to 11000 per tonne predicting an average price of 9675 per tonne in 2021. Goldman Sachs slashes iron ore price forecastsDec 17. Benchmark thermal coal is expected to hit US190t in the December quarter and average US137t in 2022 while metallurgical is expected to average US230t in.

After iron ore prices hit 931 per ton on April 3 Goldman Sachs recommended investors pocket gains. While prices are not likely to remain above 200 per ton there wont be a collapse and they could hover between 100 to 150 per ton analysts at the Singapore Iron Ore Forum said. Analyst estimates for iron ore.

In the report Goldman reiterated its bullish forecast for a copper price of 11000 a tonne just below 5 per pound by the end of the year and 11500 by this time next year. Moving the global economy toward net zero. Total export value for iron ore is forecast to be 137 billion in 202122 and 113 billion in 202223.

Decade-low iron ore hits miners. Iron ore prices to rebound to 115ton in 3 months Goldman Sachs NEWS 8132019 15133 AM GMT By Dhwani Mehta. Hence Goldman Sachs upgrades benchmark price forecasts for both thermal and metallurgical coking coal.

This was up from their previous expected average of 8625 per tonne predicted in December 2020. The bullish forecast also expected prices as high as 15000 per tonne by 2025. Raised its iron ore forecasts for the remainder of the year after a surprise rally at the start of 2016 while warning that the price revival may store up problems as.

Goldman tips iron prices to fall to 35 a ton in 2017 and 2018 down 14 percent from its previous prediction of 40. Eamonn Sheridan Category. Goldman Sachs expects the iron ore market to move into surplus in late MayJune on higher Australian and Brazil shipments and lower ex-China steel demand.

It sees the benchmark price range-bound between 60 to 70 a tonnes over the next 12 months. On March 15 Morgan Stanley lowered its forecast for iron ore benchmark prices by 14 to 40 per ton for 2016 and by 17 to 37 per ton for 2018. While the bank believes that the prices can go higher from here it recommends investors take.

Goldman Sachs thinks the worst of the correction in iron ore prices is now over. The price of ore delivered to China from Australia the biggest shipper of the steelmaking raw material will average 150 a metric ton next year up from a forecast of 140. Goldman Sachs Group Inc.

15 Bloomberg -- Goldman Sachs Partners Australia Pty raised its forecasts for iron ore prices from 2012 to 2015 on concern supplies from Brazil the worlds second-biggest exporter will be lower than expected. How low will prices go. The bank prices.

Goldman Sachs still like iron ore for the next 6 months at least AUD bulls will like this post Thu 14 Jan 2021 223948 GMT Author. Goldman Sachs see prices falling back to 110 a tonne by the fourth quarter The high-grade Brazilian index 65 Fe fines also advanced to a record high of 21110 a tonne. Iron ore dump.

A worsening mismatch between global iron ore supply and demand prompted JPMorgan Chase to reduce price forecasts through 2018. Prices are forecast to average around US150 a tonne in 2021 before falling to.

Pin On China

Fed Says It Will Keep Stimulus Coming For Years Stock Market Economy Investors

Natural Gas Futures Rose To The Highest Level Since July 2011 And Stocks Of Domestic Gas Producers Also Rallied After Eia S Weekly Repo Nature Clouds Outlook

Goldman Sachs Likes Iron Ore Near Term But Says Prices Will Fall In 2018

![]()

Pin On Key Signals

Sometimes You Must Go Against The Wave Before You Catch The Ride Of Your Life Waves Life Riding

Pin On Mgix Commodity Polymer And Chemicals News And Intelligence

Aud The Commodity Currency Investing Com

Goldman Sachs On Iron Ore Bull Run Outlook

Talk Of Euro Dollar Parity Has Resurfaced Goldman Sachs Is A Structural Usd Bull Resurface Dollar Euro

Pin On Key Signals

Business Insider Australia Business Without The Bs

Pin On Latest News

Goldman Sachs Says Watch The Chinese Yuan If You Want To Know Where Iron Ore Prices Are Heading

Pathfinder Minerals Pfp Mozambique Indicate It May Become The World S Third Largest Exporter In The Coming Years Http Www Pathfinder Minerals Investing

Pin On Pbmf 4th Block

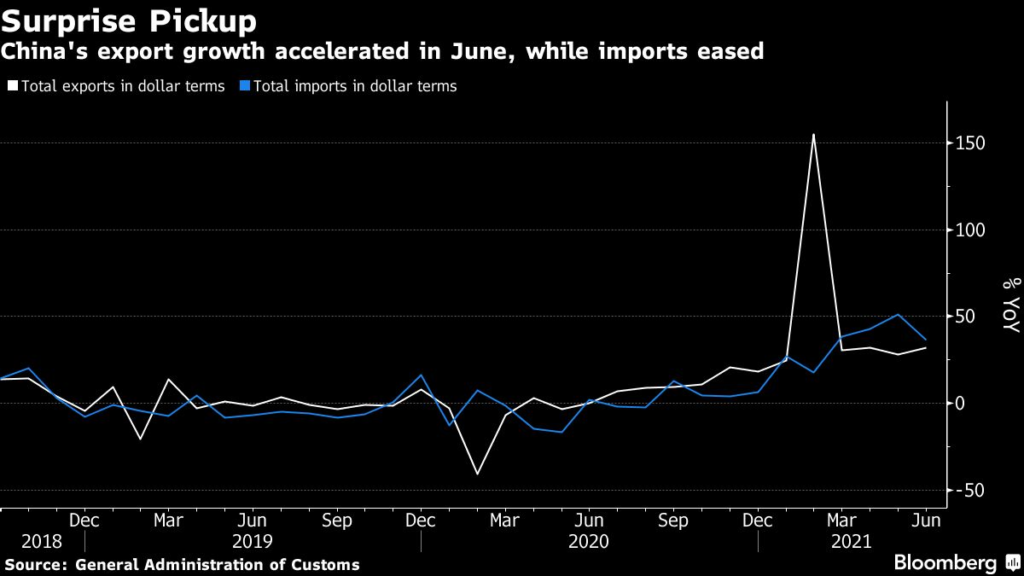

Iron Ore Price Up On China S Export Growth Mining Com

Pin On Key Signals

Iron Ore Stocks Rise After Goldman Boosts Price Outlook